Avenue 55 is currently erecting three buildings in the Spanish Springs Business Center. Photo: Devcon Construction

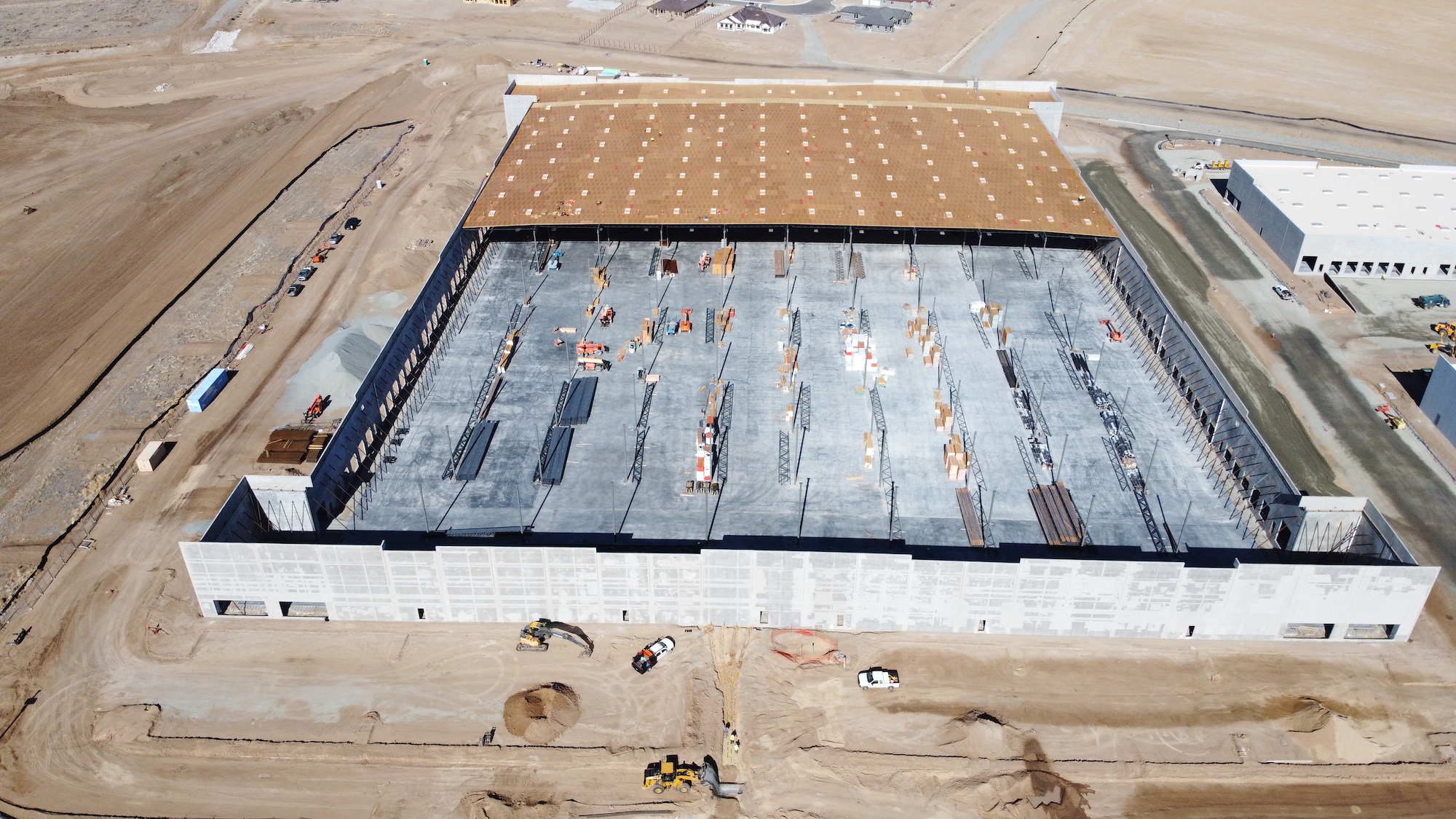

Sitework is underway at The Park At McCarran. The project includes one building totaling 1 million square feet that's already pre-leased to a single tenant, as well as two smaller speculative buildings. Photo: United Construction

Sitework is underway at The Park At McCarran. The project includes one building totaling 1 million square feet that's already pre-leased to a single tenant, as well as two smaller speculative buildings. Photo: United Construction

The 594-acre master-planned Spanish Springs Business Center along Pyramid Highway will essentially be at full capacity once Avenue 55 completes construction on the final three buildings. Photo: Devcon Construction

The 594-acre master-planned Spanish Springs Business Center along Pyramid Highway will essentially be at full capacity once Avenue 55 completes construction on the final three buildings. Photo: Devcon Construction

Comments

Use the comment form below to begin a discussion about this content.

Sign in to comment